40+ federal reserve interest rates mortgage

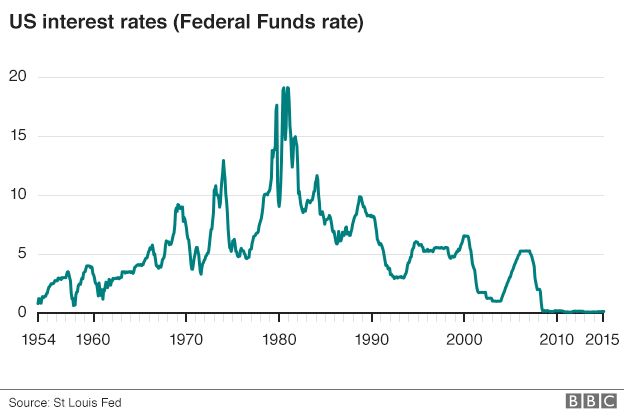

Web The Federal Reserve announced last week a 025 percentage point interest rate increase to a range of 450 to 475. Web By Brian Cheung.

How The Federal Reserve Affects Mortgage Rates Nerdwallet

Web 1 day agoThe average 30-year fixed mortgage interest rate is 708 which is an increase of 7 basis points from one week ago.

. Last month on the 8th the average rate on a 30. Web The Federal Reserve is set to raise interest rates after seven hikes last year as the central bank tries to tamp down inflation while avoiding a recession. Apply Get Pre-Approved Today.

Web The average rate on a 30-year mortgage has fallen 075 percentage points in the past month or so after hitting a 20-year high of 708 in early November. Web Todays Mortgage Rates Here are your rate options sorted by Refinance 30-year fixed rates for 300000 property value and 240000 loan amount in 60602 Edit. Web In addition to the actions it takes with the federal funds rate the Federal Reserve has a much bigger impact on mortgage rates.

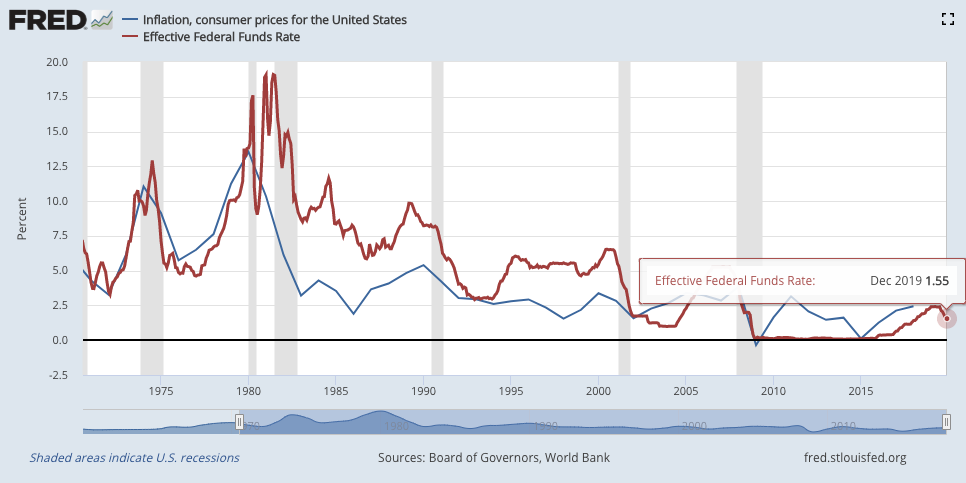

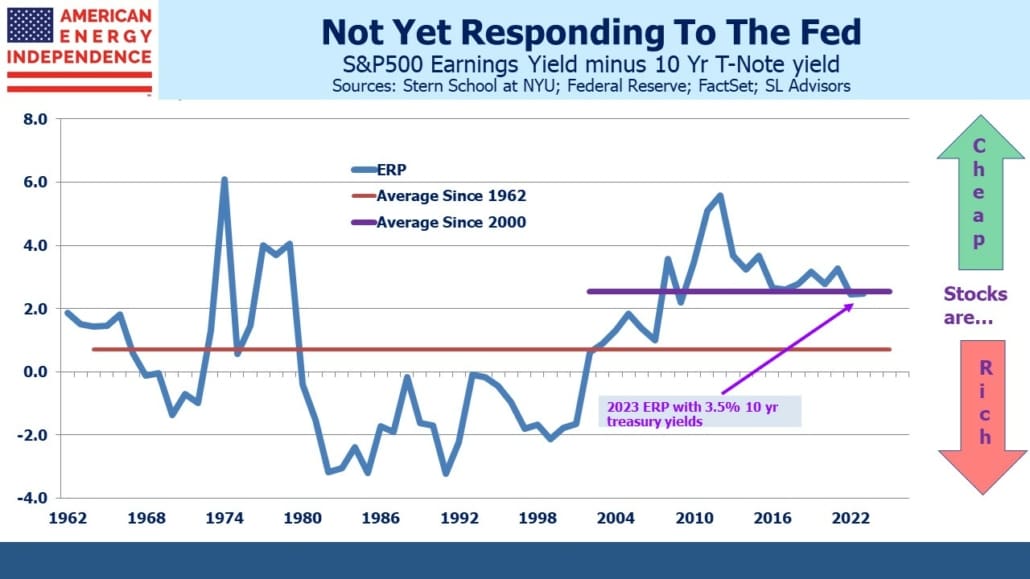

Web Compiled by Mark Sprague State Director of Information Capital The other day was the Federal Reserve meeting. Ad Compare the Best Home Loans for March 2023. Web As we see rates rise we will see the attractiveness of government debt increase and the returns to stocks and other risk assets lowered.

Ad Compare the Best Home Loans for March 2023. Ad Compare Lowest Mortgage Refinance Rates Today For 2023. 14 2022 to a range of 425 to 45 the seventh increase.

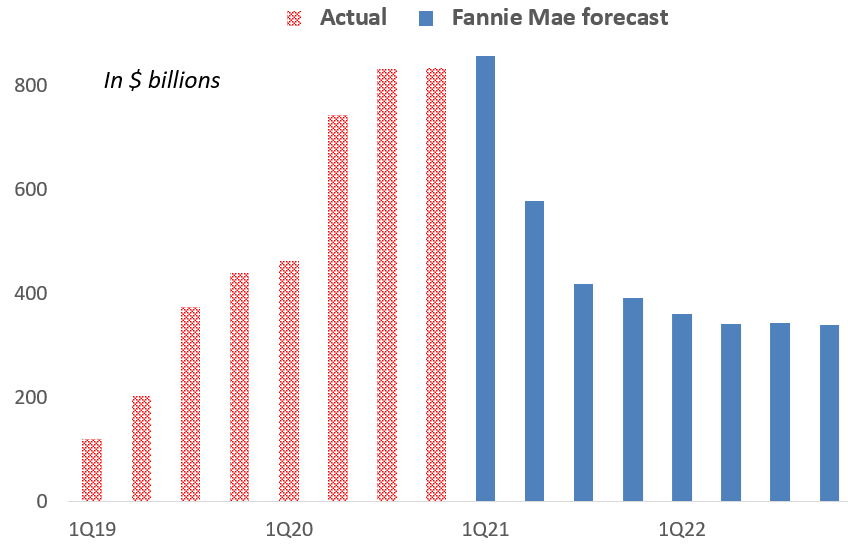

Ad Dedicated to helping retirees maintain their financial well-being. This is because the Federal Reserve began buying at least 10 billion worth of agency MBS per month starting in. Web THE CONVERSATION The Federal Reserve raised interest rates by half a percentage point on Dec.

Web The answer is because mortgage interest rates are set on projections and expectations. Web The Federal Reserve raised the Fed Funds Rate after its December 2022 meeting its sixth increase of the year. Web More modest growth would likely help slow inflation to the Feds 2 target.

Web 13 hours agoFederal Reserve economic data shows the average 30-year fixed-rate mortgage is almost 67 which is about 25 higher than a similar mortgage one year. Apply Get Pre-Approved Today. Web According to Bankrates latest survey the average 30-year fixed-rate mortgage is currently 708.

Low Fixed Mortgage Refinance Rates Updated Daily. Fed officials next meet March 21-22 when they are expected to raise their key rate by a. The Federal Reserve doesnt determine mortgage rates.

Youll typically get a lower interest rate compared to. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Web 14 hours agoNew data out Wednesday showed mortgage applications rose 74 from the week prior according to data from the Mortgage Bankers Associations MBA.

The groups policy rate is now set at a range of. With the federal reserve raises rates it is actually to curb inflation which. Web A 51 adjustable-rate mortgage has an average rate of 587 an uptick of 7 basis points from seven days ago.

No SNN Needed to Check Rates. Federal Reserve Chairman Jerome Powell told lawmakers Tuesday that policymakers may have to speed up their interest rate hikes to tame high. Web 6 hours agoAfter a historical rate plunge in August 2021 mortgage rates skyrocketed in the first half of 2022.

Get Instantly Matched With Your Ideal Mortgage Lender. Web The average rate for the benchmark 30-year fixed mortgage is 711 percent up 8 basis points over the last week. The Federal Reserve is not likely to change.

A basis point is equivalent to 001. The Best Lenders All In 1 Place. If the Federal Reserve continues to raise interest rates.

Lock Your Rate Today. Web In January 2020 the Federal Reserve kept the target range at 15 to 175 because the economy was moving toward a 2 inflation rate. Their decision was another 75-basis point ¾.

Lock Your Rate Today. Get Instantly Matched With Your Ideal Mortgage Lender. Web Annualized Inflation came down from a 40-year high of 91 in June to 85 in July.

Web The FHA charges borrowers an annual mortgage insurance premium MIP and in January 2015 the FHA abruptly reduced the MIP and thus FHA borrowers. Indeed the 30-year averages mid-June peak of 638 was almost. See if you qualify.

Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

The Fed Delivers Biggest Rate Hike In Decades To Fight Inflation Npr

Us Mortgage Rates Hit 21 Year High As Fed Action Weighs On Housing Sector Us Economy The Guardian

How Mortgage Rates Move When The Federal Reserve Meets Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Why Mortgage Interest Rates Will Go Down In 2023 In Texas

The Cost Of Quality Themreport Com

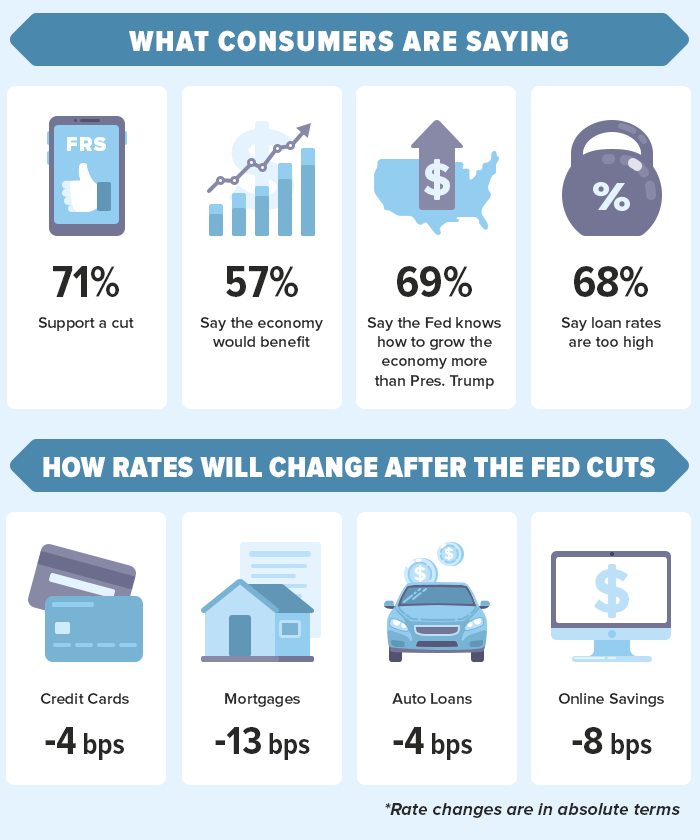

Why The Fed Lowered Interest Rates Again The New York Times

Rocket Companies Law Of Supply And Demand Has Not Been Overturned Nyse Rkt Seeking Alpha

Best Mortgage Lender First Time Buyers Financial Samurai

U S Mortgage Interest Rates Top 4 For First Time Since 2019 Reuters

Biggest Weekly Mortgage Rate Drop In 40 Years Is Good News For Buyers

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

Us Rate Rise Why It Matters Bbc News

Mortgage Refinance Applications Are Collapsing What S The Impact On The Economy Markets Wolf Street

Category Bonds Are Not Forever Sl Advisors

Fed Slashes Rates To Near Zero And Unveils Sweeping Program To Aid Economy The New York Times

October 2019 Fed Rate Cut Probability Analysis

The Fed Delivers Biggest Rate Hike In Decades To Fight Inflation Npr